Podcast: Play in new window | Download

Most angel investors aren’t looking to wade hip-deep into the projects they support. It’s not the best use of their time, and it’s a needless distraction from the business of investment. What a professional investor is looking for is a founder with that perfect mixture of enthusiasm and experience, and a motivated team behind them that can turn a great idea into a great business.

Most angel investors aren’t looking to wade hip-deep into the projects they support. It’s not the best use of their time, and it’s a needless distraction from the business of investment. What a professional investor is looking for is a founder with that perfect mixture of enthusiasm and experience, and a motivated team behind them that can turn a great idea into a great business.

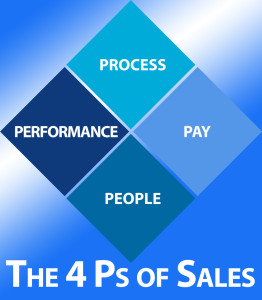

In today’s episode, host and business coach Tom Ryan talks about what it means to have a great team, and why great founders often matter more than great business ideas. As always, Tom is joined by co-host and producer Jason Pyles. Continue reading